The Slog

by John Ward

by John Ward

BEIJING IS IN TROUBLE: WAKE UP & THINK ABOUT IT

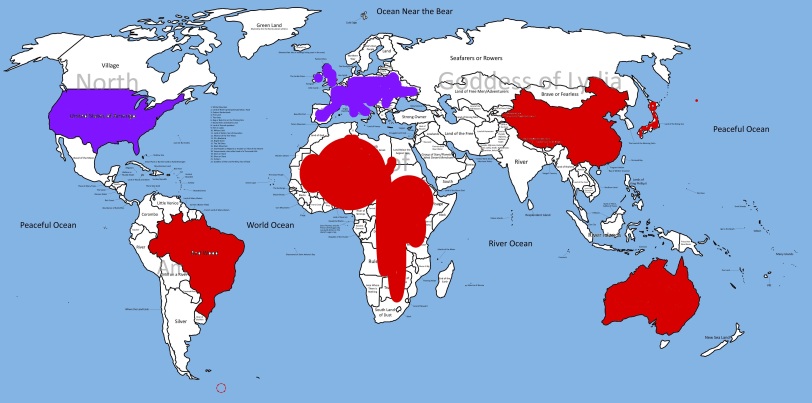

You won’t see many visual aids simpler than the one above. The countries in red represent China’s biggest trading partners and (in particular) suppliers. The purple people have the most debt owned by China.

China is struggling to contain a major credit crunch within its own banking system: last Tuesday, the People’s Bank of China injected 29 billion yuan through reverse repos in open market operations on Tuesday morning. And interest rates within China’s interbank market spiked to their highest level since June in recent days.

So: that now makes India, China and – yes, amazingly – the UK mulling higher interest rates which, you’ll recall, will not be allowed to happen until everything is just fine. Well, hate to say I told you so…but it’s happening, guys.

However, while about 90% of the acres of Western sites and newsprint don’t give a monkey’s about Sino liquidity crunches, as you can see a China that doesn’t solve its problem will completely screw the exports of the folks in red, and get even more antsy about big debtors seemingly intent on just one thing – vapourising the debt they owe to China with that good old money printing bazooka.

Higher interest rates and nervous creditors will increase the borrowing costs of the US, UK and EU so much, they’ll all default.http://hat4uk.wordpress.com/wp-admin/post-new.php

And a China bringing down the import shutters will collapse the Brazilian, Australian and African economies as well.

That leaves just Japan then, whose printing stimulation will hurt those latter economies further…and turn Tokyo into a basket case right next door to an atomic meltdown.

But don’t panic, because we’re turning the corner into a boom, so everything’s just fine. Merry Christmas. Only one more misery inducing Slogpost to go, and then you can pour yourselves into the Holidays.

Δεν υπάρχουν σχόλια:

Δημοσίευση σχολίου